Pick n Pay Shakes Up Financial Landscape with Launch of New Domestic Money Transfer Service

Pick n Pay announced that it has launched its store-to-store domestic money transfer service.

The informal cash usage in the country remains high, and this service will be interoperable across all Pick n Pay supermarkets, Clothing stores, and Boxer stores in South Africa, spanning a network of over 1,400 outlets.

The Pick n Pay Money Transfer service, developed to focus on simplicity for customers, has a single registration process.

Follow these simple steps:

-

Visit any Pick n Pay store: Customers only need to sign up once with their identity document when accessing the service in any store.

-

Provide identification: Present your identity document during the sign-up process to verify your identity.

-

Complete registration: Fill out the necessary registration forms provided by Pick n Pay staff.

-

Receive transaction PIN via SMS: After each transaction, senders receive a PIN via SMS to share with the receiver.

-

Share PIN with receiver: Share the received PIN with the intended recipient.

-

Access funds at affiliated stores: Receivers can immediately access the funds at any affiliated store, including Pick n Pay, Clothing, or Boxer.

With a minimum transfer amount of R50, daily limits capped at R3,000, and monthly limits at R25,000, the service caters to various financial needs. Notably, a flat transaction fee of R8 applies to senders, regardless of the amount transferred.

Due to the strong demand for money transfer services among South Africans, the landscape is fiercely competitive and rapidly evolving, encompassing offerings from banks, retailers, Mobile Network Operators (MNOs), and emerging platforms like PayShap.

Store-to-store money transfer services play a pivotal role in this dynamic ecosystem. They facilitate secure and convenient transactions from one individual to another, typically across different locations, bridging gaps for individuals who don’t have access to traditional banking or digital infrastructure.

Deven Moodley, executive of Value Added Services at Pick n Pay, emphasises the transformative impact of their new money transfer service, stating, "This will provide a secure and convenient avenue for transferring money in South Africa, all at the most competitive price in the market."

He adds, “This service is designed to enhance convenience for our customers, leveraging our extensive network of store locations spanning three brands. By offering this simple and cost-effective solution, we aim to empower communities across South Africa, enabling seamless monetary transactions for all.”

From remittances to bill payments and emergency funds access, store-to-store money transfer services address various financial needs, especially for day workers who rely on cash payments and seek safe channels for financial management.

Absa will facilitate Pick n Pay's Money Transfer service. The retailer has a five-decade partnership with Absa to meet the evolving needs of South African consumers. “The market for store-to-store money transfer services in South Africa is experiencing steady growth, driven by the rising demand for accessible and affordable financial solutions,” said Chris Wood, managing executive for Product at Absa Relationship Banking.

Supplied by; Pick n Pay.

Guzzle Media

Tags:

#PicknpayGet The Latest News & Specials

You successfully subscribed, thanks!

THIS WEEK'S TOP STORIES

An Explainer: What Drives the Cost of Cooking Oil

Celebrate Mother's Day with The Crazy Store

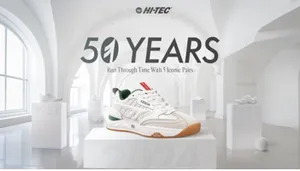

Run Through Time With Hi-Tec